Toronto city council has deferred a vote on adopting a set of controversial proposed taxes until after the provincial election this fall.

After a day of heated debate, councillors voted to defer the decision until the October election, effectively making the proposed taxes an election issue.

Some councillors believe a new provincial administration could be more sympathetic to Toronto’s fiscal problems.

Councillor Suzan Hall introduced the motion to defer the vote at council Monday evening.

She hopes a new provincial government can be convinced to reverse at least some of the downloading that has added hundreds of millions to Toronto’s budget.

“It’s something like $173 million that we’re paying out for health benefits for people on Ontario Works,” Hall told the Toronto Star on Sunday, referring to the province’s social assistance program.

“That is really a provincial responsibility.”

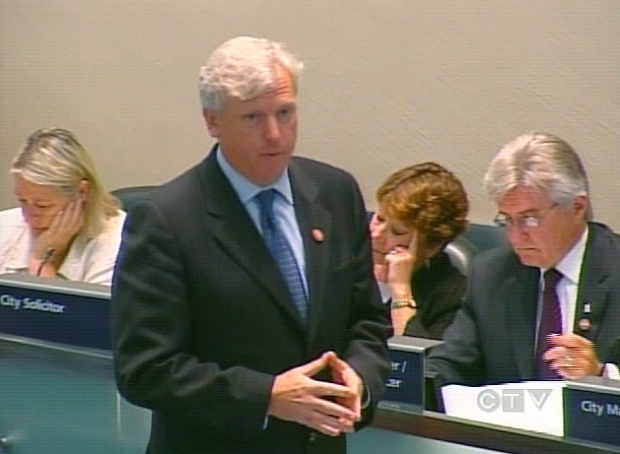

Toronto Mayor David Miller spent the weekend trying to drum up the support of councillors on two tax increases that he says are vital for the city’s long-term success.

The 45-member council was supposed to vote Monday on the proposed land transfer tax and vehicle registration fee, “revenue tools” Miller says would raise $356 million a year for cash-strapped Toronto.

It was standing room only as concerned citizens lined the council chamber and listened to Miller make an impassioned plea for council to approve the proposed taxes.

“Members of council, we have a very important, a very difficult but essential question to answer today and it’s a clear question,” Miller said.

“The question is will this city government have the ability to invest in this city of Toronto to ensure our success in the twenty-first century.”

Councillors are divided on the crucial vote; one observer is calling the most important of Miller’s administration so far.

The mayor worked the phones on the weekend trying to convince councillors on the fence to support the tax increases.

Right-wing councillor Case Ootes says the vote lies in the fate of five or six councillors.

The taxes, if implemented, would see homebuyers pay about $4,200 more on an average Toronto home, while an annual vehicle registration tax would cost car owners $60 and motorcycle owners $30.

If the tax hikes aren’t approved, the city will have to implement “significant” property tax hikes, Miller has warned.

“Or there will have to be very significant service cuts — the snow-clearing service in North York will be gone very quickly, leaf pickup in Etobicoke, things like that will be gone, and that will be just the start,” he told the Star.

Opponents of the proposed taxes say councillors who vote in favour will pay a heavy political price.

Councillor Doug Holyday, who is leading the opposition, told the Star he will urge the Toronto Real Estate Board and local ratepayers’ groups to take out full-page ads in major newspapers naming councillors who vote in favour of the new taxes.

A poll released Thursday showed almost 70 per cent of Toronto residents believe taxes should not be implemented until they are debated during the 2010 municipal election.

With reports from CTV’s Desmond Brown and Roger Petersen